China now has five privately owned banks. That’s a big step forward for the country’s prosperous banking sector which is undergoing major transformations as it strives to develop a better system. The increase to five came as the China Banking Regulatory Commission said Monday that it has approved two private banks -- one in Shanghai, the other in Zhejiang Province.

The CBRC approved the establishment of three private banks, including Webank, funded by the Chinese Internet giant Tencent, in July. The two newest private banks don’t have official English names yet. The CBRC requires the new banks be established within six months from Monday.

"The establishment of private banks in China will provide a good compliment for the country’s state-owned banking sector, especially the funding for SMEs." Central Univ. Of Finance And Econ.Prof. Guo Tianyong said. "Private banks have the know-how of using information technology for banking services, which will push the overall banking sector in China to improve and become more modernized and competitive."

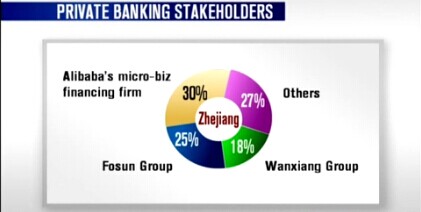

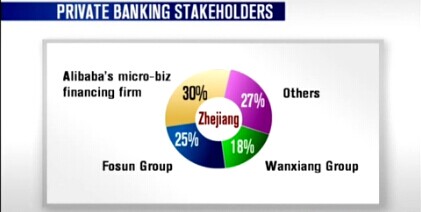

Private banking stakeholders funders for Zhejiang bank.

A 30 percent stake of the Zhejiang-based bank will be funded by a micro-business financing company that’s indirectly controlled by the Internet powerhouse Alibaba. The Shanghai-based conglomerate Fosun Group will contribute 25 percent of the funding, and China’s largest auto parts supplier, Wanxiang Group, will hold an 18-percent share.

Private banking stakeholders funders for Shanghai bank.

The new Shanghai-based private bank will have 30 percent of its funding from Juneyao Group, another Shanghai-based conglomerate. Fifteen percent of its funding will come from Metersbonwe Group, a leading Chinese casual wear apparel company.

China now has five private banks but only one is in service. That’s the China Minsheng Bank, which was founded in 1996 in Beijing.